Although I have always liked the restaurant Panera there isn’t one that close to where I live so I don’t go there very often. A couple of months ago I did end up there with my sister and I got a Panera Card for free and they told me to take it home to register it. I put it in my desk drawer and didn’t think about it again until my friends decided we should go to lunch at Panera. The night before I got out the card and registered it. I clicked on the “My Surprises” section of the website and it gave me a free Espresso or Smoothie that I was able to use the next day. Even better, my friend was able to get a card that day, register it on the internet on her phone, and get a free drink also. Now under the “My Surprises” tab I have a $1 off of any drink. If you are going to eat at Panera it can’t hurt to get a card.

Although I have always liked the restaurant Panera there isn’t one that close to where I live so I don’t go there very often. A couple of months ago I did end up there with my sister and I got a Panera Card for free and they told me to take it home to register it. I put it in my desk drawer and didn’t think about it again until my friends decided we should go to lunch at Panera. The night before I got out the card and registered it. I clicked on the “My Surprises” section of the website and it gave me a free Espresso or Smoothie that I was able to use the next day. Even better, my friend was able to get a card that day, register it on the internet on her phone, and get a free drink also. Now under the “My Surprises” tab I have a $1 off of any drink. If you are going to eat at Panera it can’t hurt to get a card.

Category Archives: Our Frugal Stories

Get Free Stuff From Panera

We Got a Free Gift From At&t U-verse

So when we moved into the house we live in now we were unable to transfer our current internet/cable provider and the choices were limited. We ended up choosing At&t U-Verse. This week in the mail we received a free pizza and movie from them for being with them for a year. What a nice surprise! They also unexpectedly gave us $150 in Visa gift cards for signing up for a cheap plan with them.

So when we moved into the house we live in now we were unable to transfer our current internet/cable provider and the choices were limited. We ended up choosing At&t U-Verse. This week in the mail we received a free pizza and movie from them for being with them for a year. What a nice surprise! They also unexpectedly gave us $150 in Visa gift cards for signing up for a cheap plan with them.

We have had good luck with their customer service. Read my article about How One Phone Call Saved Us $343.

Our Experience as a One Car Household

This has been a very interesting year for our household, although when is life ever dull? It was shortly after I lost my job that my boyfriend’s car blew a head gasket and was no longer worth fixing. This left us as a one car household with a decision to make. Do we go and finance buying a new car, losing money the second we drive it off the lot, but knowing it would be reliable, or did we save up to buy a quality used car which can save a lot of money in the long run as long as it’s not a lemon? A couple members of our family had recently had bad experiences buying used cars which made us especially wary.

This has been a very interesting year for our household, although when is life ever dull? It was shortly after I lost my job that my boyfriend’s car blew a head gasket and was no longer worth fixing. This left us as a one car household with a decision to make. Do we go and finance buying a new car, losing money the second we drive it off the lot, but knowing it would be reliable, or did we save up to buy a quality used car which can save a lot of money in the long run as long as it’s not a lemon? A couple members of our family had recently had bad experiences buying used cars which made us especially wary.

We live in an area where there might as well be no public transportation so owning a car isn’t optional. We decided that since I wasn’t working we didn’t immediately need a 2nd car and would save up money for as long as we could until we absolutely had to have a car with the idea that hopefully we would save enough and buy a car before we had to finance one at a dealership.

Six months later we had saved up enough to buy a new-to-us car. We bought a 2006 Nissan Sentra that we found on Craig’s List. It was sold by the original owner, who was looking to sell this car because he wanted to buy a new larger vehicle for work. He had all of the records showing that he had done excellent preventative work on the car. We were excited but were determined to have a vehicle inspection done before we proceeded any further. I will never buy a used car without one, especially off of Craig’s list where scams are common. I learned from reading a book by financial expert Clark Howard that a car seller can legally lie to you about the condition of a car so it’s important to protect yourself.

We are lucky to have a fantastic mechanic who was able to go that day to look at the car. He noticed several things that we, not being people who know a lot about cars, had missed. This helped us when it came to negotiating the price of the car and also let us know that the breaks needed new pads and other inexpensive but important work right away. The money we paid for the vehicle inspection was worth every penny. It gave us a clear picture of the car we were buying and also set our minds at ease that we weren’t buying a complete lemon. Had a relative of mine done this he could have saved himself thousands of dollars he spent on a car that was a complete lemon and also on the repairs he then had to pay for.

What Helped Us to Only Need One Car-

1. There are only two of us in our household which means less people to shuffle around

2. One of us wasn’t working so there were no conflicting work schedules

3. We live close to family who was more than willing to help us with rides and let us tag along on errand runs. Thank you so much!

4. We worked around each other’s schedules to make it work!

How we saved money-

If you follow this blog then you already know about the thousands of ways we save every day but here are a few that really stood out to me during this period

1. Needing less gas from only having one car

2. Not needing to pay for insurance on two cars anymore

3. Bringing a lunch to work every day instead of buying

4. Cooking at home instead of going out to eat

5. Spending more time at home instead of going out

6. Postponing any other large purchases that were less necessary until after we had bought a car

7. Going over our bills and calling the companies that provide our services (Phone and Cable +Internet) and were able to reduce our bills just by calling

8. Did I mention couponing?

9. Also using up things we already had in the house A.K.A. our coupon and pantry stash

10. Less access to a vehicle meant less trips to the store overall. We often followed policy of “Use it up, wear it out, make it work or do without!” If we couldn’t make it to the store I decided we really didn’t need whatever it was that badly no matter how good a deal.

Things We Learned About Buying A Used Car-

I will say it again, we aren’t people who know a lot about cars, so that definitely made it much harder to know what to buy and when but we did learn a lot during this process.

1. ALWAYS get a vehicle inspection

2. Buying a car with a salvage title is a good indication it has been in a wreck and may cost more to insure or be hard to find an insurance company

3. A car that has just had a paint job may look nice but be hiding something

4. If you are looking for a used car beware of scams, never send anyone money

5. If the title isn’t in the owner’s name they are probably buying the car and flipping it which isn’t a good sign (I believe this is illegal)

6. Used car lots will often charge a lot of additional fees ex. Dealer Fees, so make sure you know the real price before you commit

7. It never hurts to see a Car Fax or equivalent vehicle history report

8. Always try to negotiate a lower price

9. It’s a good sign if the owner has extensive vehicle records on repairs, oil changes, etc.

10. Always test drive on the highway because higher speeds can reveal a lot of problems that slower speeds hide

11. If your gut is telling you it’s too good to be true, it probably is

12. If you have someone who knows about cars ask for their help

13. Google, google, google things to look for/at when buying a used car

14. Look, look, look and then call, call, call- being familiar with prices can help you determine a fair car price in this economy and the area you live in and then make calls to car owners to help rule some out

15. Ask a million questions- if they aren’t willing to answer or you catch them in a false statement then it is probably a bad sign

In the end, we actually were faced with a decision- We knew we had to go on a 8 hour road trip to a sister’s college graduation. We didn’t feel comfortable driving our only car (reliable but older) that far, so we knew we either had to buy a new car within a week or pay around $300 to rent a car to drive up there which would dig into our car savings. We were very fortunate to find a car that week that was everything we were looking for and to pay a fair price for it. I guess you could say that we knew that if we didn’t feel that the car was good enough for a long road trip immediately then that ruled it out for us.

Our road trip went off without a hitch and our car got us there and back with no problems. We are very happy with our new car and enjoy having greater freedom from owning two vehicles; however, our one car experience does make us think twice about hopping in the car to go anywhere which is still saving us money on gas and vehicle wear and tear. We no longer take the freedom of mobility for granted and are very excited to be driving our new-to-us car!

Rebates – Are they worth it?

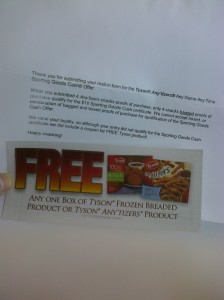

I recently received a $3 postcard check for a Lysol rebate that I did so long ago I thought for sure it wasn’t coming. Then, this week I received a $10 Publix gift card from the Kimberly Clark rebate (see HERE) and I heard back from the Tyson’s rebate (see HERE) which I apparently didn’t qualify for but they sent me a coupon for a free item anyways.

I recently received a $3 postcard check for a Lysol rebate that I did so long ago I thought for sure it wasn’t coming. Then, this week I received a $10 Publix gift card from the Kimberly Clark rebate (see HERE) and I heard back from the Tyson’s rebate (see HERE) which I apparently didn’t qualify for but they sent me a coupon for a free item anyways.

I have mixed feelings when it comes to rebates. I don’t like the idea of buying something just because I will get the money back in a few months. I never consider rebates a guarantee, an example being the Tyson rebate above, because rebates often take a long time and usually it is hard, if not impossible, to track them.

I have mixed feelings when it comes to rebates. I don’t like the idea of buying something just because I will get the money back in a few months. I never consider rebates a guarantee, an example being the Tyson rebate above, because rebates often take a long time and usually it is hard, if not impossible, to track them.

That being said, there are some cases where I will do rebates-

1) If a rebate lines up with a deal I am already doing, as was the case with the Tyson rebate HERE

2) If it is for something I already needed to buy anyways

3) If I really, really want to try the product, usually because it’s something I will use

In these cases, I will do the rebate because I already feel that I have gotten a good deal or bought something I needed and then the rebate is just the icing on the cake. That way if it doesn’t work out I don’t feel like I wasted my money.

How I Got a Treadmill for $30!

This week I was very excited when I got a great surprise. I have been wanting to buy a treadmill for months now. When I lived at my old, old apartment complex they had a small gym where I would go, usually being the only person there, and watch tv while I ran on the treadmill. However, since I moved out of that apartment complex I haven’t had access to a gym. Although we have been creative with exercising, including running in our neighborhood and playing tennis at the park on our street, I often want to exercise when I’m home alone. We live in a decent neighborhood, but I don’t think it’s safe in general for a woman to go jogging alone frequently. I reached my savings goal a month ago and gave myself a budget of $200 for a treadmill but then a financial setback meant that it wouldn’t be wise to spend the money on a non-necessity.

This week I was very excited when I got a great surprise. I have been wanting to buy a treadmill for months now. When I lived at my old, old apartment complex they had a small gym where I would go, usually being the only person there, and watch tv while I ran on the treadmill. However, since I moved out of that apartment complex I haven’t had access to a gym. Although we have been creative with exercising, including running in our neighborhood and playing tennis at the park on our street, I often want to exercise when I’m home alone. We live in a decent neighborhood, but I don’t think it’s safe in general for a woman to go jogging alone frequently. I reached my savings goal a month ago and gave myself a budget of $200 for a treadmill but then a financial setback meant that it wouldn’t be wise to spend the money on a non-necessity.

So imagine my surprise when I received a phone call from a local thrift store that I had asked if they would call me if they got in a treadmill. The nice gentleman who works there told me, “Well we’ll try. If we remember we’ll call.” I figured it never hurts to ask but I wasn’t expecting to hear from them anytime soon. Then, not only did they call me, but they were also saving the treadmill for me and only wanted $29.95! I said, “I’ll take it!” My family cautioned me that I shouldn’t agree to buy something before I saw it, but I had a great feeling about it.

The treadmill is in great condition (although I know you can’t tell from my poor quality picture). It has a working electronic screen, a ski function (how you use it I have no idea), it inclines, plus it’s really, really fast! It’s exactly what I wanted and for $170 less than I was willing to pay too!

My Experience with Natural Toothpaste

I recently became interested in Natural and Organic products after educating myself about chemicals and additives. I also wanted to be healthier. One of the first things I bought was Tom’s of Maine Toothpaste when I got a good deal at CVS. I continued using it until I ran out and then I went ahead and grabbed a tube of regular toothpaste because I had some in my couponing stash.

I recently became interested in Natural and Organic products after educating myself about chemicals and additives. I also wanted to be healthier. One of the first things I bought was Tom’s of Maine Toothpaste when I got a good deal at CVS. I continued using it until I ran out and then I went ahead and grabbed a tube of regular toothpaste because I had some in my couponing stash.

Within days my mouth was on fire. My entire life I have suffered from severe Canker Sores or mouth ulcers. I have been to doctors but the cause is unknown (they are not the same as cold sores which are caused by a virus) and there isn’t much they can do. Because the sores come and go, I hadn’t made the connection that once I stopped using regular toothpaste I hadn’t had a problem.

The next day, I went to Big Lots to get more Tom’s of Maine toothpaste in the deal I wrote about HERE. I am no expert or doctor but it makes me wonder what is in regular toothpaste that could contribute to Canker Sores, especially because their cause is unknown. Even though I can’t usually find Tom’s of Maine products for free after coupons, as long as it continues to help me, I’m willing to pay a little more.

What I Do With Free Laundry Samples and Free Trial Size Laundry Products

When it comes to free samples, I find that I get samples for free laundry products quite frequently. Since I have been a couponer I have also been able to get a lot of Free Trial Size Laundry Products. Instead of throwing them in a drawer or cabinet and forgetting about them, I have a small basket that was given to me where I keep them by my washing machine. That way, I am able to grab laundry samples when I need them or want to use them and I never have to worry about completely running out of laundry detergent. This helps me to go longer in between buying laundry detergent. I know that this is a small thing to do to save money, but nice laundry detergent isn’t cheap and little things really do add up.

When it comes to free samples, I find that I get samples for free laundry products quite frequently. Since I have been a couponer I have also been able to get a lot of Free Trial Size Laundry Products. Instead of throwing them in a drawer or cabinet and forgetting about them, I have a small basket that was given to me where I keep them by my washing machine. That way, I am able to grab laundry samples when I need them or want to use them and I never have to worry about completely running out of laundry detergent. This helps me to go longer in between buying laundry detergent. I know that this is a small thing to do to save money, but nice laundry detergent isn’t cheap and little things really do add up.

How One Phone Call Saved Us $343

When we moved into our new house about 6 months ago we got a really great introductory deal on internet and cable. Yes, we have cable. I know that cable is a highly debated item in the frugal world, with most people believing that you should just do without. In another situation, I would be one of the people without cable. However, we do have cable because 1) We got it at a very low rate 2) I feel that what we pay for it monthly is a good investment in spending time in our home and spending less money going out 3) We are in a position where we can afford it. A trip to the movies for two people can easily cost more than what we pay for it monthly. Now that I have overly explained myself (does my guilt at having cable show?), I can move on with my story.

When we moved into our new house about 6 months ago we got a really great introductory deal on internet and cable. Yes, we have cable. I know that cable is a highly debated item in the frugal world, with most people believing that you should just do without. In another situation, I would be one of the people without cable. However, we do have cable because 1) We got it at a very low rate 2) I feel that what we pay for it monthly is a good investment in spending time in our home and spending less money going out 3) We are in a position where we can afford it. A trip to the movies for two people can easily cost more than what we pay for it monthly. Now that I have overly explained myself (does my guilt at having cable show?), I can move on with my story.

So we got a really great introductory deal on cable and internet when we moved, which actually included $150 in Visa gift cards we had no clue we were getting, that we were able to use to buy our TV, one of the very few home purchases we have made since moving (See How We Got a 46 inch Flat Screen TV for $149). As we all know, the catch with introductory deals is that they end and then the company raises the price. The new $55 a month higher price was not a good deal. But I had a plan for that! A competitor offered us similar service for the introductory price so we could have switched but instead I decided to call and politely let out current company know about competitor’s price and also problems we had been having with our internet service. After an amount of negotiating they reduced our price back down and gave us free internet for one month (which I wasn’t expecting).

This one phone call which took less than half an hour saved us THREE HUNDRED AND FORTY-THREE DOLLARS and that’s not even including the lower taxes we will pay on this lower bill. I don’t particularly enjoy making phone calls like this but like most people in America, I don’t make over $300 in half an hour so this was a huge savings for a little bit of time and energy.

My next phone call project is going to be switching my car insurance.

Read How My Next Phone Call to the Phone Company Also Saved Us A Lot Of Money- Why You Should Double Check Your Phone Bill- It Might Save You Hundreds

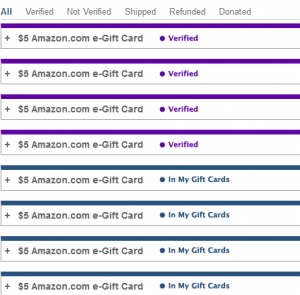

I Earned 4 More Free $5 Amazon.com Gift Cards From Swagbucks

I’m very excited that I have once again earned enough Swagbucks to get 4 more FREE Amazon.com gift cards. As we all know, Amazon.com sells a little of everything so I’m looking forward to some FREE SHOPPING!

I’m very excited that I have once again earned enough Swagbucks to get 4 more FREE Amazon.com gift cards. As we all know, Amazon.com sells a little of everything so I’m looking forward to some FREE SHOPPING!

If you have never heard of Swagbucks.com, you earn points simply by searching on their site or even printing coupons!

My strategy is to try to do a few searches on their search engine in the morning and evening and usually I’ll win swagbucks from searching around twice a day just for doing normal searches. I also usually do their daily poll because I find it interesting and that earns 1 swagbuck. They also have lots of special offers that I only do if they interest me. For example, I’ll usually watch a video if they offer around 10 swagbucks. All of this is really easy to do and doesn’t usually take any extra time out of my day. Click the banner below if you want to join.

2-3-12 Shopaholic Savers Update- Organic/Natural Deals and Healthy Food Deals

I think it’s safe to say that all of this started with my three New Year’s Resolutions. I wanted to be healthier, do even better financially and be even more green (eco-friendly)!

I think it’s safe to say that all of this started with my three New Year’s Resolutions. I wanted to be healthier, do even better financially and be even more green (eco-friendly)!

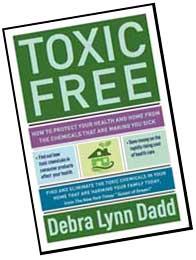

Let’s start with Be Healthier! Little did I know that in January I would stumble across a book called Toxic Free by Debra Lynn Dadd which very thoroughly exposes chemicals residing in our homes and products that we use every day. I was not completely ignorant of this because my mother was always very careful about chemicals she used in our home while I was growing up. These include Bleach, Tilex, Pest Control Sprays, etc. because that’s what they are- chemicals! I was also not as aware as I should have been of the chemicals in items like shampoo and deodorant. I have never used many in my home either but now I am especially conscious of it.

The other part of Being Healthier that I am trying to follow is eating healthier. Both reducing the chemicals in my house and eating healthier lead me to wanting to use more organic products when I am able to.

My next New Year’s Resolutions was to do even better financially. The question then becomes- How do I start replacing chemicals and foods in my house for more Organic, Healthier, Greener options and at the same time not spend a ton of money?

I have decided that I am not going to go through the house and throw away all of our cleaning products and stockpile that I may no longer want to use in my home. What I am going to do is slowly start replacing products when I find good deals and looking for better options. As I do, I am going to donate or sell the items that I will no longer be using.

This is what I have done so far-

– I realized that every woman’s deodorant in my house contains Aluminum. So I am now using baking soda instead. You simply apply a small amount when you are damp from the shower and it disappears just like deodorant would. So far it has worked great!

– I started a compost to create soil. I am planning to start planting in a couple months when the weather gets warmer. Hopefully this will save money on fruits and veggies that won’t be grown with pesticides. My mother actually offered me this small plastic bin when I was looking for something to put my compost in so I didn’t have to pay for that either.

– I bought some Tom’s of Maine products that were a great deal at CVS this week. I was able to use gift cards so it was zero out of pocket. Click HERE to see that post.

– I was out of Tilex and instead of going out and buying more I created my own cleaner from equal parts baking soda and vinegar to green clean my shower. We have been very sick in my household for about a month which means that there was some mold and mildew growing that with some light scrubbing my homemade, green cleaner took care of. Click HERE for more green cleaner ideas. Most homemade cleaners are green and I was excited that many could be made from items I already had in my house for FREE and don’t have to cost a lot of money.

– I received a cast iron skillet for Christmas from my brother that I was excited about because now I have an alternative to Teflon. My boyfriend’s mother also recently gave me a stoneware cooking item that is also much healthier to use.

All of this being said, I am going to start doing more blog posts in two new categories. Natural/Organic Deals and Healthy Food Deals. So check back to see what I come up with!

Follow Us!