1. Keep Bananas Fresh Longer– This is so easy I can’t believe I never heard of it. I love having bananas in the house but I hate it when they go bad before we can eat them all. To keep them from browning longer all you have to do is wrap them in a plastic bag and twist it closed. I use the plastic grocery bag I took them home in.

1. Keep Bananas Fresh Longer– This is so easy I can’t believe I never heard of it. I love having bananas in the house but I hate it when they go bad before we can eat them all. To keep them from browning longer all you have to do is wrap them in a plastic bag and twist it closed. I use the plastic grocery bag I took them home in.

2. Use a Baking Mat– They can be used instead of foil over and over again. They actually help prevent food from burning and you can wash them in the dishwasher. So easy!

3. Unplug all kitchen appliances unless you are currently using them– How many years have you been paying electricity for a microwave, coffee maker and toaster that you use for maybe one hour a day? I wish I had that money back and I bet you do too. I was surprised how quickly this became a habit for me.

4. Use Less Dishwasher Soap– When I had a crappy dishwasher I had to almost completely wash every dish before they went into the dishwasher. I found out (and later read in an article) that you don’t always have to use the double dose or both cups of dishwasher soap to get a load of clean dishes. Experiment and see how little you can get away with.

5. Wait Until Your Dishwasher is Full– A Dishwasher cycle is the same no matter how many dishes you use so you might as well find out how much you can put in it and still get the same clean dishes.

6. Run Your Dishwasher at Night– By running it at night you can turn off the heated dry function and your dishes will be dry in the morning. This also saves money because of #7

7. Use Non-peak Hours for Electricity Savings– Many electric companies charge less if you use your appliances during non-peak hours when the electric grid is less active, like at night.

8. Cook Food in your Microwave– A microwave is much more energy efficient when cooking food than turning on your whole oven or stove top. Click HERE for more information about it. I use my microwave to brown ground meat- it’s faster and easier. Many meals can now easily be made in the microwave.

9. Eliminate Paper Products– We don’t buy napkins ($2 a pack), paper towels ($6 a pack), paper plates ($4 a pack) and disposable cups ($4 a pack). That’s at least $16 a month savings. I have an easy system where we keep reusable napkins (in place of paper) and hand towels and rags (in place of paper towels) in a drawer for easy access. I also keep a small hamper in the kitchen that I throw them in when I’m done. I add these to the regular wash. To save time we don’t even fold them, just put them out of site in the drawer. This is also a green idea. I love saving trees.

10. Make Use of Your Freezer– It’s known that freezers work better when full. If you make extra food, instead of leaving it in the fridge to spoil, freeze it in meal sized portions. Or freeze extra bread until you will need it.

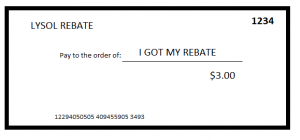

11. Stock Up on Free/Cheap Products– When kitchen products are free with coupons stock up. I have a nice stash of dish soap and cleaning products so that I never have to pay full price.

12. Soap is Soap– This is something that a scientist told my mother at the Orlando Science Center. I often use dish soap as hand soap because it’s cheaper. I personally like Olay Hand Renewal. The label even tells you it’s for hands. My mother has also used shampoo for laundry detergent over the years because she could often get it for cheaper.

13. Make Your Own Cleaning Products– Many can be made by things you have in your kitchen already. This also helps eliminate chemicals from your home. Click HERE to see a great list of easy products to make.

14. Buy in Bulk/Stock Up– This applies to anything you can get a good deal on and reasonably store and use before it goes bad. You know what space you have and what you use frequently. I recently stocked up on canned chicken (HERE) because it will last for years and I know we buy it regularly.

15. Use Every Last Drop– Make sure that you get every last drop out of any product in your home. Some easy strategies include- Turning a bottle upside down, adding water and shaking, cutting a container open, and using a spatula to get the rest of something out of a jar. Click HERE to read an article I wrote about it.

16. Don’t waste– It’s a sin the amount of food that Americans throw away. The biggest problem in my household of two people is eating all of something before it goes bad. I’m trying to do a better job of using leftovers for new meals and freezing extra portions. For example- Last night we had baked chicken and tonight I will use the remaining chicken to make a chicken and rice meal.

17. Eat What You Already Have– This also helps eliminate waste. I love making dinner from items that I already have in my kitchen. Take stock of the items that have gotten lost in the back of your pantry and use them in meals before they expire.

18. Be Organized– Nothing makes me madder than buying something and realizing I already had it in the fridge. Being organized will help you know what you have and what you need to use.

19. Make Use of Your Kitchen Utensils and Appliances– Why have them if you don’t use them? I have a glass dish that is partitioned down the middle and is perfect for holding two side items and even better I can heat both up at once saving electricity.

20. Don’t Buy Expensive Plastic Containers– The container your butter comes in may not be as stylish as Gladware but it works just as well. Containers food comes in can be washed and reused the same as expensive plastic food storage products.

21. Store food in Reusable Holders– Using the pot I cooked a stew in and covering it with the pot’s matching lid or using a glass container with a lid saves me from having to wash additional dishes and also saves money by using less foil and plastic.

22. Don’t buy more than you need– Sometimes a larger bottle is a better value but if you will never use all of it before it goes bad it isn’t saving you money to buy a larger size

23. Make it From Scratch– For the price of a couple packages of cookie dough I can buy all of the ingredients to make cookies from scratch and have lots of flour, eggs, and sugar left over for other meals. Another advantage is that you know exactly what is going into your food.

24. Double Your Milk– Click HERE to read how to double your milk. This may also work for highly concentrated juice.

25. Add Water– Adding water to items that are highly concentrated does dilute them but sometimes you don’t need an item at full strength, whether dish soap or milk. This can stretch your hard earned dollars in a way you won’t even notice.

26. Filter Your Own Water– Buying a Brita type filter pitcher has been proven to pay for itself. I hate paying for bottled water and water from your own faucet is a hundred times cheaper.

27. Use The Web– The internet is full of really great recipes and there are sites that will even give you recipes based on ingredients you have in your house. Supercook.com is one of these.

28. On Cold Days Run Your Appliances– Running the dishwasher and using the oven on a cold day will help heat up your house and save on heating expenses, especially if you were going to use them anyway.

29. Use Less Dishes– Anything that has to be washed requires time, energy, and money. I try to use as few plates, utensils, and cups as possible. For example when making bagels I will use the same knife for the butter and then cream cheese because butter will not contaminate the cream cheese. I am very, very careful about contaminating foods but some are compatible. Other easy ideas would be using the same cup all day or sharing a spoon for stirring your morning coffee.

30. Shop at Dollar Stores– Some products work the same no matter how much you pay for them. Small kitchen utensils can be bought very inexpensively. Dollar Tree even has a section devoted to them. Click HERE to see other items I found there for extremely cheap.

What do you think? Does anyone have any ideas that I missed? Leave a comment below, I would love to read them!

I recently posted an article, How One Phone Call Saved Us $343 and it made me really think about other bills and if there were ways to lower them. Today, I called At&t about our family plan phone. I pay this bill indirectly through my mother because it isn’t in my name but it’s still cheaper to have all of our phones together on one plan. For the most part our plan is really basic, besides for one thing. My mother had added an unlimited early nights and weekend calling feature to our plan a couple years ago when we kept running out of minutes and running up the bill.

I recently posted an article, How One Phone Call Saved Us $343 and it made me really think about other bills and if there were ways to lower them. Today, I called At&t about our family plan phone. I pay this bill indirectly through my mother because it isn’t in my name but it’s still cheaper to have all of our phones together on one plan. For the most part our plan is really basic, besides for one thing. My mother had added an unlimited early nights and weekend calling feature to our plan a couple years ago when we kept running out of minutes and running up the bill.

Follow Us!