If I need or want something there is nothing I like better than finding a way to get it for free! That being said here are many of the things we don’t pay for. If we can do it or make it ourselves we do and I’m proud of that. It isn’t always easy but it’s definitely worth it financially.

When BudgetsAreSexy posted an article on this recently I realized that I had written an article on the same subject a loooonnnnnngggg time ago and never published it. So with a lot of revisions, here it is.

Things We Usually Don’t Pay For

1. Haircuts– My aunt went to beauty school and she cuts my family’s hair for free. We return the favor in other ways. My father and B cut their own hair using men’s hair cutting razor kits. If you don’t know someone who cuts hair/aren’t adventurous enough to do it yourself many beauty schools will cut hair for free/cheap.

2. Most Toiletries– I do not pay for shampoo, conditioner, razors, body wash, dish soap, and some makeup because I get these products for free through couponing.

3. Most Cleaning Products– Once again I so many cleaning products for free through couponing I never have to buy them anymore. I also find that soap, water and a rag work just as well as many cleaning products.

4. Paper Towels– I use washcloths and hand towels instead of paper towels and I use reusable napkins and plastic cups instead of disposable ones. This is also a green idea and cuts back on the amount of trash my household produces. See- Making Rags to Use Instead of Paper Towels or See- Use This Not That Paper Towels

5. Paper Napkins– We use reusable cloth napkins, most of which were given to us as a gift. See- 30 Ways to Save Money In Your Kitchen

6. Paper Cups and Plates– We use the real thing and then our dishwasher See- Frugal Reflections and Dishwashers

7. Plastic Silverware– Again we use the real thing

8. Car Washes– I think it would be great to have someone else wash my car but I would never want to pay for it. Drive through car washes are cheaper but still more expensive than doing it yourself. I got a car wash kit for one Christmas and it works just fine. Plus I tell myself it’s good exercise. Ways to get them for free- There is a local place that offers free car washes with an oil change and also the Mercury dealership that my father goes to offers free car washes for Mercury vehicles.

9. Take Out Coffee– Who hasn’t read an article on this? Making coffee every morning for two people like my boyfriend B and I do (I can usually get the coffee and flavored creamer for free/almost free) can save up to $4 a day or $1,460 a year and that’s a low estimate. See- What to Do When You Run Out of Coffee Filters

10. A Home Phone– Who needs one when you have cell phones? Note- Check with your internet provider, many have changed the rules so that you no longer need a home phone line in order to have an internet connection.

11. Trash Pickup– My old apartment complex offered trash pickup for $35 dollars a month ($420 per yr) and instead we drove our trash to the trash compactor on our way out of the complex.

12. Magazines– My mom, sister and aunt all buy them and they all give them to me after they finish with them. I also get free magazines off of the internet and a parade magazine in the Sunday paper. See- Why I don’t pay for Magazines

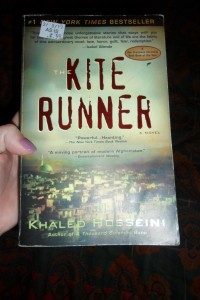

13. New Books– I do actually buy used books when I find them for dirt cheap; however, I am including them on the list because you can get them from the library for free. Many libraries now allow you to reserve books and movies online and then pick them up when they arrive (My local library will mail them right to your house). See- How You Can Save 100% at Any Bookstore

14. DVDs– They can be borrowed, you can get them free from the library, I get free Redbox rental codes, and we have Netflix. I also watch movies online for free. See- A Free Redbox Code thru May 8th 2013

15. Late fees, overdraft frees, any kind of bank fees– I get paid by my bank to put my money in the bank (as it should be).

16. Underwear– I get mailed coupons for free expensive underwear at Victoria Secret all the time. If you join their Pink Nation program and e-mail list you will also be e-mailed coupons for free underwear. I have also received free perfume and a $10 gift certificate from them. See- How I Get Free Underwear from Victoria’s Secret

17. Manicures/Pedicure– It costs $18 for a cheap manicure and $35 dollars for a cheap pedicure plus a tip. I have all of the stuff to do professional French manicures/ French pedicures myself and I get compliments all the time because people can’t tell the difference. Plus when I do them myself they actually last longer. See- Six Step Tape French Manicure

18. Plastic Storage Containers- I honestly don’t understand why these are so expensive. For large storage projects you can use cardboard boxes which you can get for free anywhere for the same purpose. In the kitchen, reusing plastic containers that food already comes in will save you from ever having to buy Tupperware of any kind. This is also a green idea because it reduces the amount of plastic that goes into landfills. See- Who Needs Gladware?

19. Health Insurance– My father pays one amount for any dependents and because he is already paying for my brother and sister, I am included until I turn 26 under the new health care laws. I do not even have to live at the same address as he does. Also my new job is going to come with free health insurance Yay! I know this will probably change in the future so I am EXTREMELY grateful.

20. Water– We have a water well so water is free for us.We don’t have a water bill. See- Having a Water Well

21. Music– I refuse to pay to download music. There are legal ways to do it for free and sharing music with friends is also easy. There are also many free music services.

22. Computer Virus/Spyware Protection– My father is a computer expert and even he uses free spyware protection. I use AVG Free Edition and Ad-aware. See- How to Get Virus/Spyware Protection for Free

23. E-mail- Does anyone actually pay for e-mail anymore?

24. Gym Membership– Many apartments have a free gym and students at the University I attended were given a free gym membership. These are expensive and most people end up not using them. I think it would be nice to have and then I ask myself- If I’m not exercising at home, am I really going to go to a gym? See- How I Got a Treadmill for $30

25. Cats and Dogs as Pets– Our childhood dog is a purebred dog that was given to us as a gift. We rescued a Maine Coon cat that ended up in my mother’s back yard and we also have a little yellow cat also rescued from the back yard. I am a huge advocate of rescuing animals instead of paying for them and not contributing to the abuse that goes on in puppy mills. In any case, do your research before you purchase an animal and make sure that it comes from a cruelty free background so your money doesn’t fund more animal abuse. There are many animals that need good homes that don’t cost anything or only cost the minimal fee that a shelter charges and you will be saving a life. We also have a three foot long ball python that was also given to us.

26. Most Pens, Pencils, Highlighters- as a recent college graduate I always got these for free during my college years. Businesses love to give away office supplies. I would go to one college club fair, job fair, or other random fair of some sort and be stocked for the semester. They also often gave me notepads, hand sanitizer, and free food.

27. Wrapping Paper– We can use comics, redecorate the bags they give you at the store, use tissue paper, use the store’s free wrapping etc. It’s the gift that counts not the wrapping. See- Frugal Gift Bags

28. Small Trash Bags– I can’t believe that stores actually sell these. Who doesn’t just use the plastic bags that you get with every purchase you make? Note- we now try to use reusable shopping bags and on the occasions we leave them at home I don’t feel bad because we usually need more small plastic bags at that point

29. Calling 411– Calling 411 can be expensive but it was free through Google. I tried the service and it worked for me. However, when I looked up the number I realized that Google ended their service. Luckily, BING stepped in. The number is 1-800-Bing-411. I’ll keep this in mind but now I usually just use the internet on my smart phone.

30. Filing Taxes– we file our taxes online for free. There are many websites that allow you to do this. See- How I did my taxes for free

31. Most Full Price Movie Tickets– I’m sure many of you love to go to the movies and so do we, but our local theatre started charging $10 a ticket and we think that’s a little extreme. So now we mostly go to free movie screenings with passes that we get due to a connection to a friend. Some of the free movies we’ve seen include The Lovely Bones, Shutter Island, Morning Glory, Sex and Other Drugs, Easy A, Jackass 3D, Zombieland, Fast and Furious, Life as we Know It, Up in the Air and more. There have also been many passes that we have received that we were not able to use. This has saved us hundreds of dollars. If there is a movie that we can’t attend a screening to and still want to see, Tuesdays are 75 cents night at our local $2 theatre. We also bring our own drinks and snacks which I usually get for free couponing. Sometimes companies also offer free movie tickets with a purchase.

32. Paying to Pay Bills– I do not pay to pay my bills, either in fees at bill pay places or in stamps. I set up free online bill pay and it doesn’t cost me a cent more than the bill amount.

33. Ringtones– I used to get them for free from myxer.com. Now most smart phones allow you to set any music as your ring tone for free.

34. Car Payments– Our Cars were bought used with cash! See- Our Experience As A One Car Household

35. Tanning– We live in Florida. Why would I pay to tan when I am lucky enough to live by the beach?

36. Return Address Labels– These always seem to come free in the mail.

37. Weed Killer– I made my own for free and it’s eco-friendly See- Homemade Weed Killer

38. Paid Phone Apps– I haven’t found one yet that didn’t have a free equivalent

39. Warranties– Never needed one past the general manufacturer’s warranties

40. Pet Houses– We make our own See- DIY Small Pet Houses

41. Salon Beauty Treatments– We do our own home beauty treatments

42. Premade Pizza Dough– We like to make homemade pizzas. I used to knead the dough by hand but the process got a lot faster when I got a Bread Maker. See- How I got a Bread Maker for Free

43. Croutons– We used crunched tortilla chips See- What to Do With the Crunched Chips at the Bottom of the Bag

44. Taco Seasoning– We make our own. See- DIY Taco Seasoning

45. Plastic Shower Curtains– We buy white cloth shower curtains so that we can wash/ bleach them and reuse them. See- Washable Shower Curtain

46. Perfume / Body Spray– I seem to have good luck getting this for free at Victoria’s Secret or Bath & Body Works, also my sister usually wants to get rid of some of hers 🙂

47. Candles– People seem to like to give these to me or I get them for free

48. Computer Work– My Dad and B have this covered for me and I know I’m lucky because this can be pricey

49. Fire Wood– We have a fire pit in the back yard and luckily someone either always ends up getting rid of some wood or there is a lot nearby where the owner allows us to collect wood

50. Cutting Pet Toenails– This can be tricky but I think it’s less traumatic for pets when we do this at home

51. Pest Control– We live in FL where there are lots of creepy crawlies. However, I would rather deal with bugs than have chemicals sprayed in my home and they usually aren’t that bad.

52. Lawn Services– B mows our lawn and I pull weeds and trim bushes

53. Maid Services– That’s all on us

54. Computer Software– All of the software I use either came with my computer or is free, including the WordPress software for this blog

55. Dry-cleaning- All of my clothes go into the washing machine. I don’t buy anything that is dry clean only.

56. Practical Things People Give Us as Gifts– I love all gifts! That includes practical gifts and items we need. I cook with a cast iron skillet from my brother, my sewing machine was from my aunt, and my microwave was from a friend. I love that many of the things I use in my home everyday remind me of the people I care about who gave them to me.

57. Upholstery– My aunt helped me to recover the chairs on my old claw foot dining room table. It was a great housewarming gift and I love the pattern that I got to pick out myself.

58. Painting– We do all of our own painting. At this house we actually chose to keep the current pain colors which saved a lot of time/energy/$.

59. Patching Drywall– I can actually patch drywall.

60. Cardboard Boxes– Whether for moving or another project, most stores love to give these away so they don’t have to haul them to the dumpster.

61. eBooks– I have gotten some really cool eBooks for free.

62. GPS updates– I use the Free Google Maps GPS on my phone so I no longer need to pay to update my GPS

63. A Planner– I used to buy one every year and now I just use the one on my phone or the one my sister got for free and gave me.

Note- This list is true 95% of the time, there is a small 5% of the time when emergencies etc come up or we decide to splurge.

Things We Do Pay For

1. Oil Changes– My dad or brother used to do it. I know that I need to learn to do it myself but until then I have to pay for them.

2. Cable– We pay about $35 for about 200 HD channels and a DVR. We like to be at home and for us one month of cable is cheaper than one meal out or going to the movies one time. As I write this, tonight we decided to stay home and watch shows on our DVR instead of going out to the movies. We saved $30 right there.

3. A Cell Phone Data Plan– I honestly don’t know how I lived without this for so long. Especially because I have two online businesses it makes my life soooooooo much easier.

4. Face Makeup– I use an expensive 4 in 1 Face Compact from PUR minerals but it saves me sooo much time and energy from having to apply and buy 4 different products. See- How to Fix A Broken Pressed Powder Compact

5. Face Cream– I use a daily Face Cream with a high SPF because the sun is strong here. I always get this with coupons and other deals. See- Getting the Most From Expensive Lotions

6. Going Out to Eat– I love date night! I also love sharing a meal out with family and friends. We use my 50% off discount at the restaurant chain I work at, we use coupons, and gift cards. See- A Frugal Date Night

7. Travel– Traveling is very important to me. I love visiting new places. Even though we try to do it cheaply I always find it’s worth every cent. See- Free In Washington D.C.

8. Clothes– I do try to save money on clothes by bargain shopping and thrift shopping. See- Thrift Shops/Yard Sales

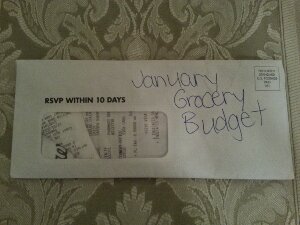

9.Groceries and Household Items- We have to eat but we try to stick to our $200 a month grocery/household budget See- $200 Grocery Budget

10. Bills– If I could figure out a way out of this I would. So instead we just try to keep them as low as possible.

11. Rent– Until we buy a house we have to pay rent. Someday this category will say Mortgage.

12. Occasionally We Treat Ourselves to Various Things We Want- We work hard and after all of the money saving we do 90% of the time I feel we deserve it. That doesn’t mean that we don’t try to save money on items we ‘treat’ ourselves with.

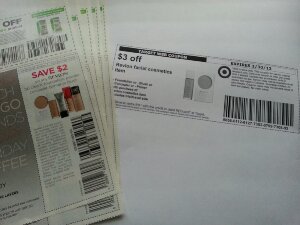

Recently my sister needed to buy more of her Revlon face makeup and we knew we were shopping at Target. So she asked me to check if I had any coupons that would work. I quickly pulled up a coupon database and typed in Revlon. Luckily, I found a $2 off manufacture coupon and even better I found a $3 off store coupon for a total of $5 off of something she was already going to buy! Not bad for 2 minutes worth of work. Minimum wage for an hour isn’t much more than that.

Recently my sister needed to buy more of her Revlon face makeup and we knew we were shopping at Target. So she asked me to check if I had any coupons that would work. I quickly pulled up a coupon database and typed in Revlon. Luckily, I found a $2 off manufacture coupon and even better I found a $3 off store coupon for a total of $5 off of something she was already going to buy! Not bad for 2 minutes worth of work. Minimum wage for an hour isn’t much more than that.

Follow Us!